Why Should You Invest in a K+ Tax Service Franchise?

This is a great question that we are eager to answer! Simply put, K+ Tax Service combines the best franchise perks and industry excellence to deliver the highest quality program on the market. Here are just a few reasons why our program is perfect for you:

- Founder, Kyala Smith, has over 25 years of experience in the tax industry

- Turn-key business model

- Statistics show a success rate by 80% or more vs. opening a non-franchised tax business

- Prior tax experience is NOT required. We offer extensive training

- Low cost total investment

- We are a 4 month business with 12 months potential earnings

- Creative marketing and advertisement to attract lifetime customers

- You are never alone!! We offer excellent tax and technical support throughout the year

- Proven track record of success with low risk.

Steps To Franchising

The process of becoming a K+ Tax Service Franchisee is simple and painless. Start by clicking here to be considered for a location. View the chart below to see what it takes:

- Submit the Request

- Interview & Review of your application

- You’re Approved!

- Get started on your way to financial freedom and entrepreneurship

Startup Cost

Here is a list of estimated expenses for prospective franchise program participants.

Estimated Franchise Startup Cost:

FAQ

HOW DOES A K+ TAX OFFICE GENERATE INCOME?

The majority of your revenue will come from the preparation of individual and small business tax returns. These fees most often come directly from the tax payers check with the assistance of our bank partners

HOW MUCH CAN I EXPECT TO MAKE FROM MY LOCATION?

Income from each location varies, based on market size, demographics, competency and ambition of the franchise owner. Your business Coach will be happy to sit down with you and set goals to help you map out a strategy to execute

HOW CAN I REVIEW YOUR FRANCHISE AGREEMENT?

Complete and submit the request for consideration (RFC). Upon approval, we will provide you with a copy of the Franchise Disclosure Document (FDD), which contains a copy of our Franchise Agreement.

HOW MANY HOURS WILL I WORK AT MY TAX OFFICE?

Many owners manage and operate their location full – time, while others maintain a full time job with frequent checkins. This decision is completely up to you. We have had many success stories in both circumstances.

HOW MUCH TRAINING WILL I RECEIVE?

We offer a 3 day extensive training on the income tax business as well as additional online tax classes to prepare you for the tax season.

ARE THERE BENEFITS TO OWNING MULTIPLE LOCATIONS?

Yes, we often give discounts for additional franchises purchased.

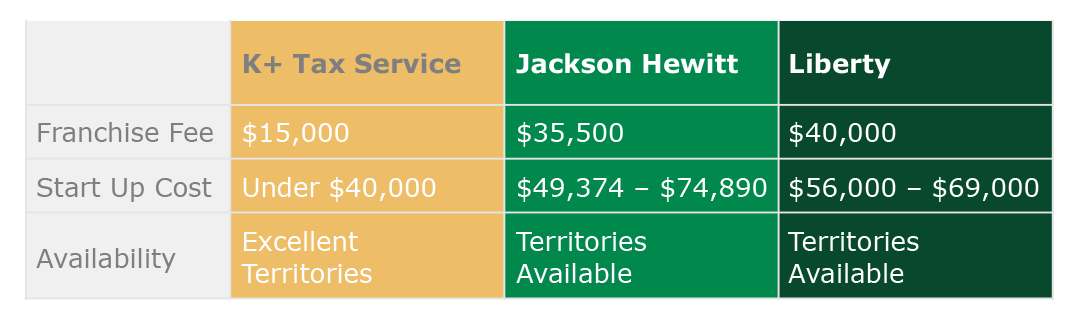

Comparison Chart

THE CHOICE IS SIMPLE

Request For Consideration

Become a Franchise Owner! Contact us today

Address

4501 Cane Run Road Ste #3

Louisville, Ky 40216

Phone: 866.335.7587

Fax: 502.654.7981

Address

4088 Murphy Lane Ste #102

Louisville, Ky 40241

Phone: 866.335.7587

Fax: 502.882.1049

Email Us

Info@kplustax.com

franchise@kplustax.com